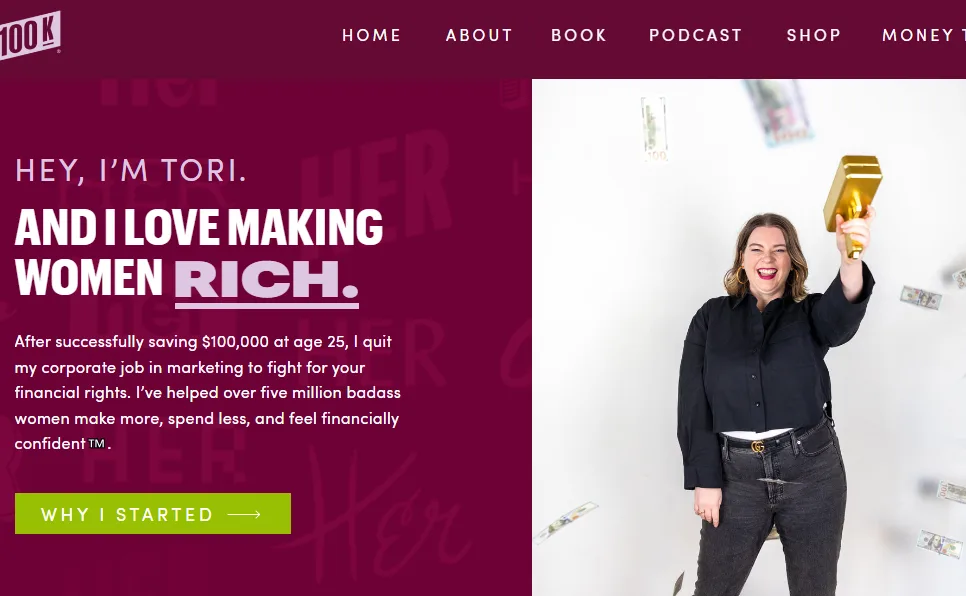

Tori Dunlap is a money and career expert, 7 figure entrepreneur and best selling author. She started at 25 when she saved $100,000 and left her corporate marketing job to start Her First $100K, a platform helping women with practical tools to overcome financial inequality. Through her work Tori has helped millions of women negotiate salaries, get out of debt, build savings, invest and launch businesses. As the host of the Financial Feminist podcast and author of the New York Times bestseller Financial Feminist she has reached a huge audience with practical advice.

She has worked with major brands like Fidelity and CitiBank and has spoken at the United Nations and Adobe. Forbes and CNBC have named Tori as one of the people redefining financial confidence for millennial women.

From $0 to $100K in 3 Years: Tom Bilyeu’s Strategies for Success

In this episode, Tori shares her insights on the following:

- Wage and Investing Gaps: Women face wage and investing gaps that hinder wealth accumulation despite their longer life expectancy.

- Power of Investing: Investing enables wealth-building through compound interest, turning small contributions into significant growth over time.

- Fear of Investing: Fear and lack of knowledge often prevent women from starting their investment journey.

- Two-Step Process: Investing requires opening an account and actively selecting investments to achieve growth.

- Diversification: Spreading investments across stocks, bonds, and funds reduces risk and ensures stable returns.

- Investment Options: Stocks offer higher returns, bonds provide stability, and funds like ETFs simplify diversification.

- DIY vs. Robo-Advisors: Investors can self-manage or use robo-advisors for automated, goal-driven strategies.

- Avoiding Mistakes: Leaving money idle without investing results in lost opportunities for growth.

- Start Small: Begin investing with even small amounts to overcome hesitation and build confidence.

- Financial Empowerment: Investing equips women to close wealth gaps, gain independence, and secure their futures.